The Federal Land Initiative helps improve use of federal lands by fostering collaboration among government agencies, local communities and private entities. Its objectives include promoting sustainable land use, enhancing public access and recreation, supporting economic development and adopting efficient land management practices. The initiative focuses on balancing environmental conservation with opportunities for economic growth and community benefits.

Protect Yourself from Fraud

Have you or your clients received a suspicious message claiming to be from CMHC or one of our programs? Stay vigilant—CMHC will never request your personal banking information or ask for payments through unfamiliar accounts.

SAVE TO MY FOLDER

Federal Lands Initiative

Share via Email

Share via Email

Share via Email

Share via Email

What is the Federal Lands Initiative?

The Federal Lands Initiative is a $318.9-million fund designed to support the transfer or leasing of surplus federal lands and buildings to eligible applicants. These properties are available at discounted or no cost, intended for development or renovation into affordable housing.

The discount on the property purchase or lease depends on the level of social outcomes achieved by the approved proposal. Once transferred or leased, the properties will be developed or renovated into affordable, sustainable, accessible and socially inclusive housing.

The Federal Lands Initiative is led by CMHC with support from:

Public Service and Procurement Canada (PSPC)

Housing, Infrastructure and Communities Canada (HICC)

Canada Lands Company (CLC)

FUND DETAILS

Budget 2024 and Canada’s Housing Plan

Budget 2024 allocated $112.6 million over 5 years to the Federal Lands Initiative, starting in 2024-25, with an additional $4.3 million in future years. This funding boosts the $200 million Federal Lands Initiative, aimed at unlocking more federal lands for housing providers to create new homes. This investment aims to create at least 1,500 homes, including 600 affordable homes and will prioritize new approaches, such as leasing, to make federal lands available to affordable housing providers.

The Public Lands for Homes Plan commits to leasing public lands instead of selling them, ensuring that public land remains public and affordable homes stay affordable.

How surplus federal property is made available for use as affordable housing:

-

Property identification: Federal government departments and Crown corporations identify property that is no longer needed.

-

Due diligence: Federal property owners perform necessary due diligence on the property (Indigenous consultations, environmental/physical condition assessments, etc.)

-

Property assessment: Federal property owners determine whether land and/or building(s) are suitable for use as affordable housing.

-

Property review: Federal Lands Initiative team reviews evaluated properties and expresses interest in suitable property. Re-zoning or pre-development work may be done at this stage.

-

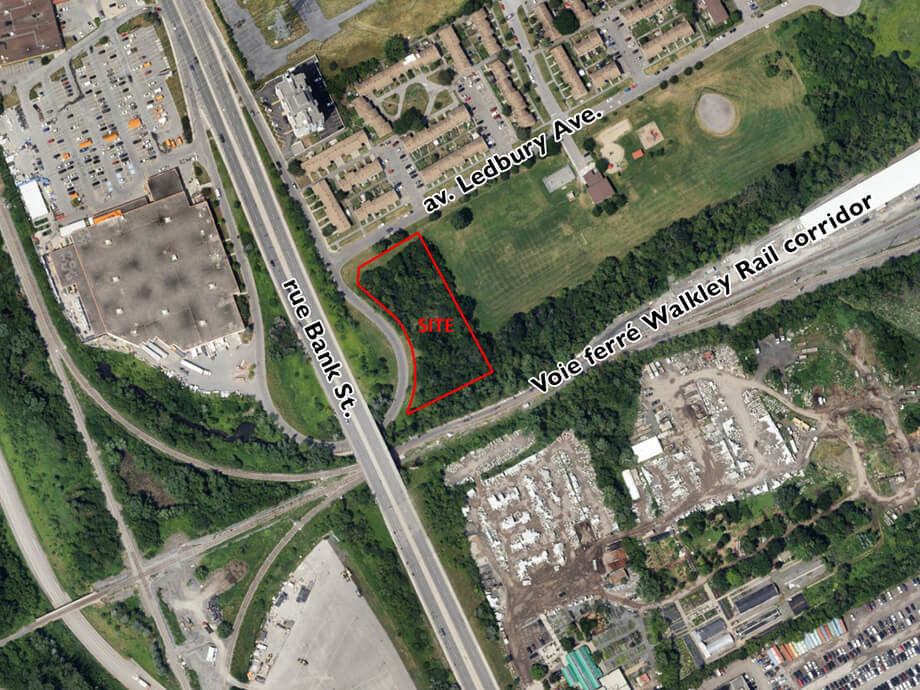

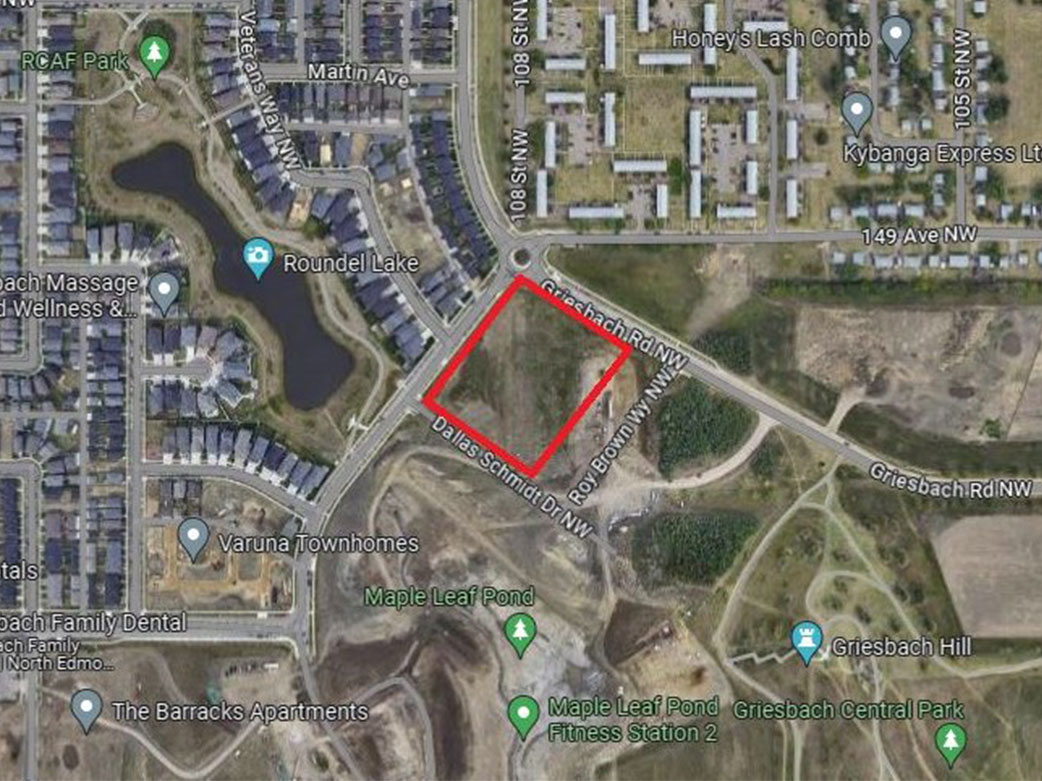

Property for sale or lease: Suitable property is made available for sale or lease through the Federal Lands Initiative and posted to the CMHC-National Housing Strategy website.

-

Applications Accepted: Housing providers apply to purchase or lease property for affordable housing project. Proposals are evaluated based on accessibility, affordability, environmental efficiency and community need.

-

Project selection: Winning application is selected and property is sold or leased at discounted to no cost. Cost is based on the project’s social outcomes, proponent experience and project proposed. Agreements are signed to ensure the property is developed and maintained as affordable housing for no less than 25 years or as otherwise specified.

-

Housing is built or renovated: Affordable housing is created or rejuvenated to the benefit of the community.

AM I ELIGIBLE?

The Federal Lands Initiative is open but not limited to the following groups:

- community housing organizations

- non-profit organizations or registered charities

- co-operative housing organizations

- municipal, provincial and territorial governments including their agencies

- Indigenous governments and organizations, including Tribal Councils

- for profit organizations

Eligible affordable housing projects include, but are not limited to:

- mixed-income

- mixed-use (commercial space should not exceed 30% of gross floor area)

- mixed-tenure

- shelters

- transitional housing

- supportive housing

- rental housing

-

affordable homeownership

- Affordability: At least 30% of units must be less than 80% of Median Market Rent, for a minimum of 25 years.

- Accessibility: At least 20% of units must meet accessibility standards outlined in CSA B651:23/652:23 OR achieve Rick Hansen Foundation GOLD Accessibility Certification (for projects seeking Rick Hansen Foundation certification, a rating score of 5 points for feature 9.11.1 is required) AND all common areas must be barrier-free. OR, the entire project – including common areas and dwelling units – must follow full universal design standards.

- Energy Efficiency: Projects must achieve Tier 2 of the 2020 National Energy Code of Canada for Buildings or Tier 3 of the 2020 National Building Code).

- Evidence of Community Need: Proponents must provide a clear description of how their project will meet the needs of the community and at least a letter of support from the municipality, a market study or waiting lists for social or affordable housing in the community.

- Experience: Proponents, or their team, must indicate a minimum of 5 years of experience in the construction/renovation and operation of projects of similar size and scope.

- Financial Viability: Projects must meet the minimum debt coverage ratio (DCR) of 1.10.

Minimum Requirements

Proposals to build or renovate surplus federal property into affordable housing must meet the following minimum requirements:

APPLICATION RESOURCES

IMPORTANT

Energy Efficiency and Accessibility Minimum Requirements

The Federal Lands Initiative minimum requirements for energy efficiency and accessibility were updated in November 2024 to align with newer codes and standards.

If you have questions or want to learn more, please contact us.

General inquiries about the National Housing Strategy or technical support

- Phone: 1-800-668-2642 (Business hours: 8 am to 7 pm Eastern Time)

- Email: contactcentre@cmhc.ca

Explore Properties

Currently there are no available requests for expression of interest or competitions.

Stay connected! Sign up for our notifications and you’ll be the first to know when properties become available.

Evaluations Underway

Still have questions about the Federal Lands Initiative?

Please connect with your Indigenous and the North Housing Solutions Specialist or Multi-Unit Housing Solutions Specialist at contactcentre@cmhc.ca or 1-800-668-2642

Let us keep you up to date

Receive CMHC’s Housing Updates straight to your inbox. Stay informed on the latest housing news, products, programs and the Federal Lands Initiative.

Please correct the following errors:

Was this page relevant to your needs?

Thank you for your feedback!

How Can We Help?

What could we improve?

Please select all that apply.

Note: You will not receive a reply. Don't include personal information.

How Can We Help?

Report a Bug

Please describe the problem.

Thank you. Your feedback has been submitted.