IMPORTANT

The application window for this property is now closed. The proposals submitted are being evaluated.

The property is currently in its natural state, offering a blank canvas for development. It is well served by public transit, ensuring easy accessibility.

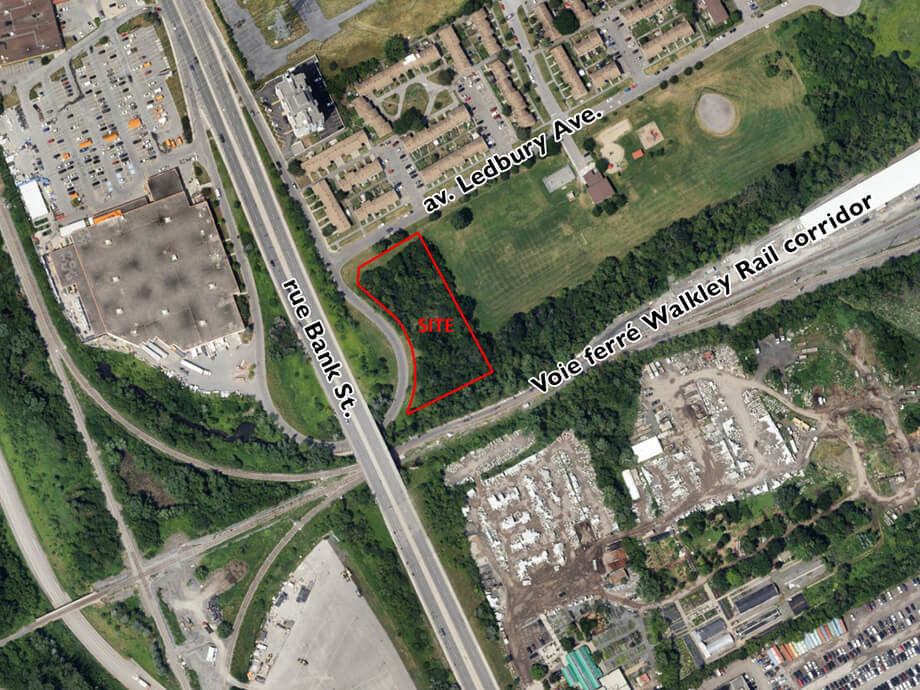

This parcel, located at 1200 Ledbury, comprises 0.497 hectares (4,973 square meters) of vacant land in the heart of Ottawa. This property is situated in a neighborhood brimming with potential, offering exciting opportunities for future growth and development. Adjoining uses to the subject site include Ledbury Park and Pavilion along the subject’s eastern boundary and the Canadian National Railway line to the south. Currently wooded, this lot is owned by the National Capital Commission.

The property is also located in a DR2 - Development zoning with floodplain overlay.

The rental market in the Ottawa region from the fall 2024 Housing Supply Report indicates the market is thriving, driven by strong demand factors, making this area an ideal location for future construction projects.

This property is being offered by the National Capital Commission through the Federal Lands Initiative.

This property is being offered by the National Capital Commission through the Federal Lands Initiative.

Share via Email

Share via Email