IMPORTANT

The request for expressions of interest for this property is now closed. The proposals submitted are being evaluated.

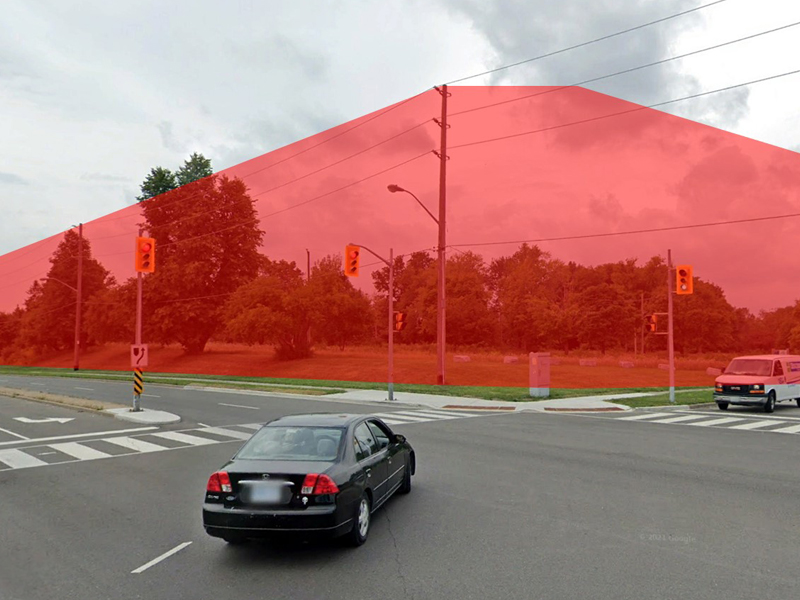

Arbo is a future mixed-use neighbourhood located at the northeast quadrant of Keele Street and Sheppard Avenue West, between Downsview Park to the south and Downsview Park TTC/GO Station to the north, in Toronto. The site is located approximately 13.6 kilometres from downtown Toronto and benefits from its location to nearby transit and Highway 401 and the 400-series highways.

The neighbourhood will be built with an existing and significant natural heritage woodlot and a new ecological park at its core. The vision of Arbo is to create a vibrant transit-oriented community that will provide a mix of housing and set a precedent for thoughtful urban development.

Arbo is being developed in multiple phases – Phase 1 includes 3 development blocks (Block 1, 3A and 3B), of which Block 3B is being offered on a land lease basis in this Request for Expression of Interest. The approved District Plan provides approximately 1,400 residential units in Phase 1, of which 280 units have been allocated to Block 3B by CLC predicated on a minimum of 30% of units must be affordable rental.

This property is being offered by Canada Lands Company through the Federal Lands Initiative.

This property is being offered by Canada Lands Company through the Federal Lands Initiative.

Share via Email

Share via Email