2020 was a year like no other. We saw increases in rent and arrears across the country. Indicators showed that tenants were reluctant to move and that there is a challenge in finding affordable rental housing. The Rental Market Report and associated data tables for 2020 is now available. Below are the national highlights as well as highlights on the major centres.

Vacancy rate and rent both increased in Canada in 2020

Overall CMAs Vacancy Rate

2.0%

2019

3.2%

2020

+1.2%

Overall CMAs Rental Rate

$1,113

2019

$1,165

2020

+3.6%

(Av. 2-bedroom apartment)

Rent arrears increased nationally due to COVID-19

Rent arrears (national table 5.0), shows the negative impact of the COVID-19 pandemic on renter households and the rental market in Canada. This is new for the 2020 survey. For those apartment structures with rents in arrears:

- 32.5% reported their arrears rate as similar to 2019

- 58.3% reported a higher arrears rate

- 9.2% said arrears were lower compared to 2019

Among Canada’s CMAs, 6.11% or 116,929 apartment units were in arrears out of a total universe of 1,912,290 units. This represented approximately $150 million in total rent in arrears or 0.59% of total expected rent. The survey suggests that 0.59% or 6.11% units in arrears were primarily apartment units with lower rents. In terms of Canada’s largest CMAs, Toronto recorded the highest arrears rate, with 10.68% of units (34,858) in arrears and 0.92% of rent (approximately $55 million) in arrears. Among all provinces, Ontario posted the highest arrears rate in Canada, with 10.18% of apartment units and 0.81% of rent (approximately $87 million) in arrears as of October 2020.

Tenants were more reluctant to move within Canada in 2020

At the national level, 14.0% of rental dwellings welcomed a new household between the last two rental market surveys. This decrease from 2019’s turnover rate of 17.3% is the largest variation since this data was first compiled in 2016. Among Canadian CMAs, none saw an increase in the turnover rate in 2020, with declines recorded in 65% of the centres surveyed. This highly similar result across the country likely reflects the reluctance of households to search for and visit new apartments or move during the COVID-19 pandemic.

Availability of affordable purpose-built rental stock a challenge for many Canadians

Table 3.1.8 provide more information on the affordability of the purposed-built rental stock. The table separates the number of units having the range of rents that would be affordable1 to each quintile of the renter income distribution in each CMA.

The renter income distribution is derived from the Census by, first, sorting renter households from lowest to highest income. Then, dividing them into five equal 20% portions (quintiles). For example, the first quintile in Toronto CMA comprises households who earn less than $25,000 annually. In order to be described as affordable, their monthly rent should account for less than 30% of their gross income. This means they would need to find an apartment renting for less than $625 a month. By comparison, in Calgary CMA, where incomes are higher, the characteristics of the first quintile of the income distribution are different. It is comprised of households who earn less than $36,000 a year. This means that a monthly rent of $900 would be deemed affordable for this group. By dividing the income distribution into quintiles, we can compare across Canadian centres accounting for the differing economic conditions.

We gain a better understanding of market imbalances among Canadian cities. We can compare the number of units in the private rental market that have rents corresponding to the different income quintiles. In a perfectly balanced market, an equal number of rental units would be affordable in each quintile. If fewer units are affordable for households in lower income quintiles, they will need to:

- spend a greater share of their income on housing

- seek non-market housing options, or

- obtain subsidies in order to cover their accommodation costs

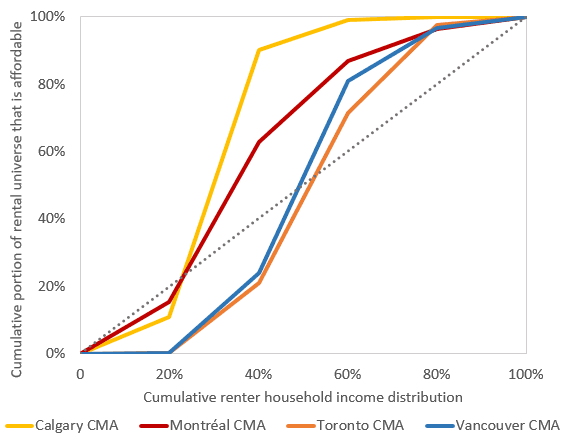

Figure 1 (Lorenz Curve) below illustrates the distribution of renter household incomes and the corresponding proportion of the rental universe that would be affordable to them.

The results show that the lower quintiles of the income distribution CMAs face significant challenges in finding affordable market rental accommodation. Just 0.2% of the rental universe in Vancouver CMA and Toronto CMA are affordable to renter households in the first quintile. Contrast Montréal, where 15% of the rental universe is affordable to households in the first income quintile. However, Montréal CMA still falls short of the share of apartments that would allow all renters in this quintile to find an affordable unit. Across cities, access to rental improves greatly by the third quintile of the income distribution. For example, a cumulative 80.9% of the rental universe would be affordable and available to the first 60% of renter households in Vancouver CMA (Figure 1).

The results also show that vacancy rates are generally lower for the most affordable units (due to higher competition). These units tend to be smaller (predominantly bachelor or 1-bedroom units). Both of these realities raise additional challenges for lower income households, particularly for families requiring more space.

This new data has revealed important differences in market rental affordability within and between major cities in Canada. It is our objective that this data can inform evidence-based discussions on this topic. This will help us move toward an environment where every Canadian has a home that meets their needs and that they can afford.

Figure 1: Cumulative portion of market purpose-built rental universe that is affordable to each quintile of the renter household income distribution, select CMAs, 2020

| Cumulative renter household income distribution | Vancouver (%) | Toronto (%) | Montréal (%) | Calgary (%) |

|---|---|---|---|---|

| 20% | 0.2 | 0.2 | 15.3 | 10.7 |

| 40% | 23.9 | 20.9 | 62.8 | 90.3 |

| 60% | 80.9 | 71.4 | 86.8 | 99 |

| 80% | 96.8 | 97.5 | 96.5 | 100 |

| 100% | 100 | 100 | 100 | 100 |

Source: CMHC (Rental Market Survey); Statistics Canada Census 2016; CMHC calculations.

1 Rent ranges are calculated at the affordability threshold of 30% of monthly income for each quintile.

Additional key highlights on the major centres are presented below with new data and notable changes. Further details on Canada’s rental market can be viewed in the full report and associated data tables for 2020.

Share via Email

Share via Email