This analysis examines trends in the credit scores of consumers before they deferred mortgage payments. The data is from the credit rating agency Equifax Canada, and is as reported to that agency.1 The data covers approximately 80% to 85% of the Canadian market for residential mortgages and includes both insured and uninsured mortgages.

Highlight of findings

- Borrowers who deferred mortgage payments, on average, had a lower credit score before the pandemic than those who did not. The difference is observed for all age groups.

- Borrowers who deferred mortgage payments had experienced a decline in credit score after mortgage origination and prior to the pandemic.

- It is likely that some of these borrowers had already been in a weakened financial situation before the pandemic hit.

- Relying on borrowers' credit information obtained at mortgage origination may not be sufficient for the ongoing monitoring of credit risk. This is due to information becoming stale over time.

Credit scores are often used to assess consumers’ creditworthiness and ability to repay their debt. Mortgage deferrals during the pandemic should not negatively impact a consumer’s credit score reported by Equifax Canada.

We analyzed the trend in consumer credit scores before the start of the COVID-19 pandemic. We wanted to understand the:

- characteristics of borrowers who deferred mortgage payments

- effectiveness of credit scores in indicating borrowers’ ability to repay

On average, borrowers who deferred mortgage payments had lower credit scores

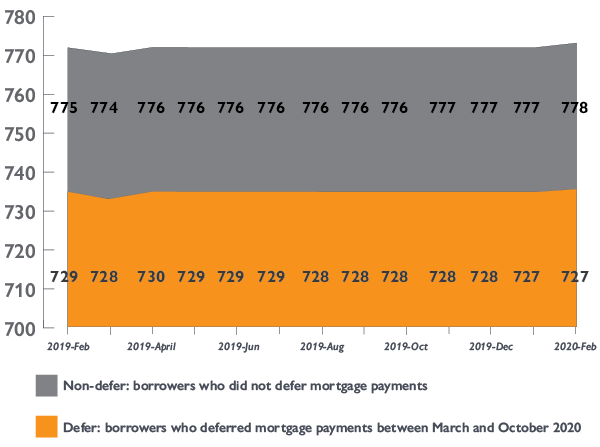

We compared the credit scores of borrowers who deferred and didn’t defer their mortgage payments between March and October of 2020. Figure 1 shows the average credit scores for the 2 groups from February 2019 to February 2020, before the pandemic. The average credit score of those who would go on to defer mortgage payments was lower than that of borrowers who would not. The difference was close to 50 points in credit score.

Figure 1: Average credit score for consumers with mortgages

| Period | Borrowers who deferred mortgage payments between March and October 2020 | Borrowers who did not defer mortgage payments |

|---|---|---|

| 2019-02 | 729 | 775 |

| 2019-03 | 728 | 774 |

| 2019-04 | 730 | 776 |

| 2019-05 | 729 | 776 |

| 2019-06 | 729 | 776 |

| 2019-07 | 729 | 776 |

| 2019-08 | 728 | 776 |

| 2019-09 | 728 | 776 |

| 2019-10 | 728 | 776 |

| 2019-11 | 728 | 777 |

| 2019-12 | 728 | 777 |

| 2020-01 | 727 | 777 |

| 2020-02 | 727 | 778 |

Source: Equifax Risk Score (ERS 2.0), Equifax Canada

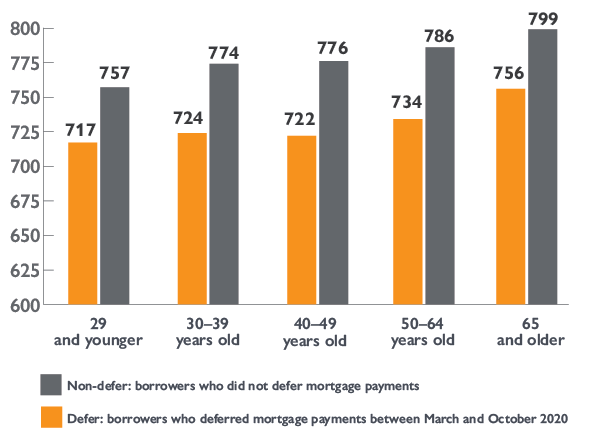

We see this difference for all age groups. Overall, consumers’ credit scores increase as they get older. Within each age group, borrowers who deferred mortgage payments had, on average, a lower credit score than those who did not. Figure 2 shows the average credit score by age group as at February 2020, the month before the start of the COVID-19 pandemic.

Figure 2: Average credit score for consumers with mortgages, by age group, as at February 2020

| Age group | Borrowers who deferred mortgage payments between March and October 2020 | Borrowers who did not defer mortgage payments |

|---|---|---|

| 29 and younger | 717 | 757 |

| 30 – 39 years old | 724 | 774 |

| 40 – 49 years old | 722 | 776 |

| 50 – 64 years old | 734 | 786 |

| 65 and older | 756 | 799 |

Source: Equifax Risk Score (ERS 2.0), Equifax Canada

The average credit score had decreased since mortgage origination for borrowers who later deferred mortgage payments

The difference in credit score between borrowers who did and those who did not defer mortgage payments stemmed from 2 factors:

- At mortgage origination, the average credit score of borrowers who later deferred mortgage payments had been lower than that of borrowers who did not.2

- After origination, the average credit score of borrowers who later deferred mortgage payments had decreased in relation to that of borrowers who did not.

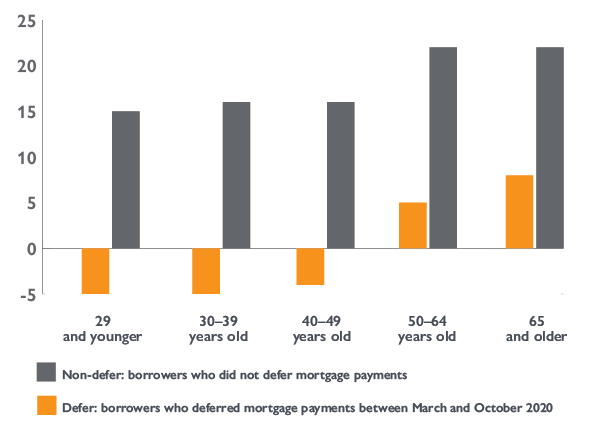

Figure 3 shows the average change in consumer credit score during the period from when a borrower originated a mortgage to February 2020. For borrowers who deferred mortgage payments between March and October 2020, 45% of them had experienced a decline in their credit score since their mortgage origination. For the upper 2 age groups, the credit score had increased, on average, for borrowers who deferred payments. However, the level of the increase was smaller than that for borrowers who did not defer payments.

Figure 3: Difference in credit score between mortgage origination and February 2020, by age group

| Age group | Borrowers who deferred mortgage payments between March and October 2020 | Borrowers who did not defer mortgage payments |

|---|---|---|

| 29 and younger | -5 | 15 |

| 30 – 39 years old | -5 | 16 |

| 40 – 49 years old | -4 | 16 |

| 50 – 64 years old | 5 | 22 |

| 65 and older | 8 | 22 |

Source: CMHC calculations using Equifax Canada data Equifax Risk Score (ERS 2.0)

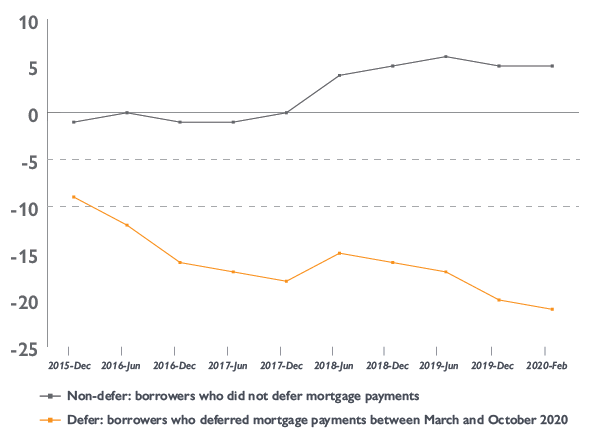

We tracked a cohort of consumers who originated mortgages in the 6-month period from January to June 2015. The goal was to assess how fast credit scores changed after mortgage origination. We chose this cohort so that we could see how their credit scores evolved in the 5-year period up to February 2020.3

At mortgage origination, there was a small difference in credit score between borrowers who later deferred payments and those who didn’t. The difference grew bigger over time. The largest divergence actually occurred among those borrowers who had an initial credit score above 749, which was Equifax’s highest score range. Figure 4 shows the change in credit score after mortgage origination for these consumers. The credit score for people who later deferred mortgage payments had started to decline in the first 6 months after they took on a new mortgage (on average). The largest drop happened in the first 2 years after mortgage origination. The decreasing trend continued to February 2020.

Figure 4: Change in credit score after mortgage origination, consumers with mortgage originated in January to June 2015 and initial credit score above 749

| Period | Borrowers who deferred mortgage payments between March and October 2020 | Borrowers who did not defer mortgage payments |

|---|---|---|

| 2015-12 | -9 | -1 |

| 2016-06 | -12 | 0 |

| 2016-12 | -16 | -1 |

| 2017-06 | -17 | -1 |

| 2017-12 | -18 | 0 |

| 2018-06 | -15 | 4 |

| 2018-12 | -16 | 5 |

| 2019-06 | -17 | 6 |

| 2019-12 | -20 | 5 |

| 2020-02 | -21 | 5 |

Source: CMHC calculations using Equifax Canada data Equifax Risk Score (ERS 2.0)

Our findings in this analysis suggest that credit scores are indicative of consumers’ debt repayment abilities. Borrowers who deferred mortgage payments from March to October 2020 had a lower credit score prior to the pandemic than those who didn’t. Some of these borrowers were likely to have been experiencing a weakened financial situation prior to the pandemic.

Relying on borrowers’ credit information obtained at mortgage origination may not be sufficient for the ongoing monitoring of credit risk. This is due to information becoming stale over time.

Footnotes

- This report uses data from the credit rating agency Equifax Canada on mortgage and non-mortgage consumer debt. For mortgages, the data covers approximately 80% to 85% of the Canadian market. CMHC did not access or receive personal identifiable information on individuals in producing the report. All figures are sourced from Equifax Canada unless otherwise stated. Unless otherwise noted, dollars are not adjusted for inflation. Equifax data is as is reported to the Bureau. The data may be revised at a later date due to Equifax data updates.

- It is needless to say that consumers who can qualify for a mortgage have good credit scores in general. The comparison in this analysis is among consumers with mortgages.

- For mortgages insured by CMHC homeowner transactional mortgage insurance, the average age of the deferred mortgages was about five years old.

Share via Email

Share via Email