The March 2021 Housing Market Assessment has been released.

Housing market showing evidence of overheating at the national level

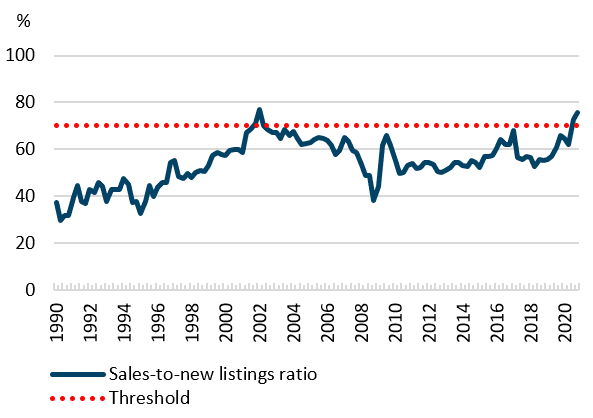

The impacts of the pandemic continued to influence housing market conditions in Canada in the fourth quarter of 2020. Sales remained elevated relative to new listings in several regions and there is now evidence of overheating at the national level.

Evidence of overheating in Canada

Sources: CREA and calculation by CMHC Last data point: 2020 Q4

This graph visually represents the estimates, used to assess overvaluation in Canada, over time. It also depicts the critical threshold for these indicators. The average overvaluation estimate remained below the critical threshold in the fourth quarter of 2020, while the maximum overvaluation estimate remained above it for two consecutive quarters.

Sustained price growth contributed to the emergence of price acceleration and overvaluation imbalances in additional markets, particularly in Eastern Canada. Among the 3 largest metropolitan areas, the degree of overall vulnerability of the housing market in Toronto moved to high. Montréal and Vancouver remain at moderate.

The short-term impacts of the pandemic led to an increase in the proportion of unoccupied rental apartments in many regions. The excess inventories in certain segments of the rental market can be a source of risk to short-term local market stability. However, the overall supply of housing remains low.

Excess inventories, previously named “overbuilding”, refers to an elevated number of newly built unsold homes or a high rental apartment vacancy rate. Such excess inventories can create financial difficulties for builders and rental companies if they struggle to repay debt used to build or buy these units.

Excess inventories are a risk even in unaffordable markets. In such markets, excess inventories should be cleared in the medium term but can present short-term risks. Centres with unaffordable housing would continue to benefit from long-term increases in housing supply. This would restrain growth in house prices and rents even if there are short-term periods of excess inventories.

Share via Email

Share via Email