Recent mortgage regulations, rising interest rates and a softening Canadian housing market contributed to a general slowing of the mortgage market in 2018 while the uninsured mortgage market grew. This analysis is according to the very first Residential Mortgage Industry Report released today by Canada Mortgage and Housing Corporation (CMHC).

This new report provides insight into the evolving mortgage industry landscape and recent mortgage market trends in Canada. It covers everything from mortgage origination to funding, insured and uninsured mortgages, and activity from all mortgage lender types, including Mortgage Investment Corporations (MICs).

This inaugural report offers a broader understanding of the growing presence of alternative lenders in the market and the role they play in the financial system. The report will be produced and released annually, while highlights will be updated and released on a quarterly basis.

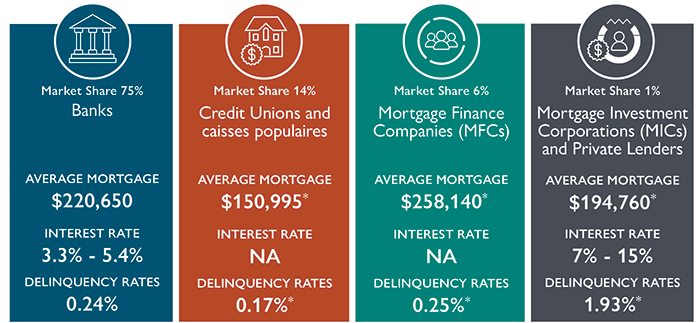

Key insights on 4 different types of lenders in 2018

Sources: Canadian Bankers Association, CMHC calculations based on Statistics Canada Custom request, Fundamentals Research and CMHC calculations based the Non-Bank Mortgage Lenders Survey

* Results from 2018 Q3

Report highlights:

Mortgage lending trends

- In 2018, mortgage originations declined due to new regulations, rising rates and softening housing markets resulting in the slowest year-over-year growth rate of outstanding mortgages in more than 25 years.

- New mortgages for the purchase of property decreased by 19%, while refinanced mortgages by the same lender decreased by 12%, compared to 2017.

Mortgage insurance trends

- The share of mortgages that are uninsured has been increasing. The increase is a result of adjustments to regulatory changes, of changes in economic conditions and of changes to portfolio insurance.

- Insured mortgage originations accounted for less than 1 in 3 new mortgage loans in 2018.

- Over time, the share of outstanding insured mortgages has decreased by about 16 percentage points from 57% in the first quarter of 2015 to 41% in the same period in 2019.

Mortgage trends by type of lender

- Last year, federally regulated financial institutions (FRFIs) held an estimated 78% of all mortgage debt.

- Credit Unions and Mortgage Finance Companies (MFCs) held approximately 14% and 6% respectively.

- Mortgage Investment Corporations (MICs) held an estimated $13 - 14 billion of mortgages outstanding. Their share of mortgage originations was more than double their share of the stock, which is partly due to their increasing market share in the uninsured space.

Mortgage rate trends

- Most Canadian mortgage consumers choose fixed-rate mortgages with 5-year terms.

- However, variable-rate mortgages have been gaining popularity. In the first quarter of 2019, the average share of new mortgages with a variable rate stood at 29%, a 12-percentage point increase relative to the same period in 2017.

Mortgage funding trends

- Deposits are the main source of mortgage funding for chartered banks and credit unions. As of the fourth quarter of 2018, the Big Six Banks funded more than 64% of their residential mortgages through deposits, while credit unions used this funding source for more than 3 out of 4 mortgages.

- Covered bonds have gained close to 1-percentage point of the funding market, reaching a record 9.5% in the same period.

- Private securitization such as RMBS and ABCP still account for a very small share of funding sources in Canada, hovering between 0.5% and 1.5%

- CMHC’s funding programs accounted for 30% of all outstanding mortgage credit in Canada at the end of 2018.

Quick facts:

- The data for this release is from 2018, unless otherwise indicated.

- In addition to data driven analysis on the mortgage market, the Residential Mortgage Industry Report includes information from stakeholders gathered during industry round tables, which is another way to understand fundamental changes impacting the mortgage industry.

- In collaboration with Statistics Canada, CMHC has developed a new survey that gathers information on mortgage lending activity in the non-bank mortgage lending space. The first results of the Non-Bank Mortgage Lenders Survey by lender type are now made available through this report.

- The data and insights for the report were gathered as part of CMHC’s housing finance data gaps initiatives, which increase the availability of data and analysis to support evidence-based policy and business decisions in the industry.

Quotes:

“CMHC makes continuous efforts in filling data gaps across the housing spectrum as they are identified. This new report gathers information from several key initiatives and partnerships including the Non-Bank Mortgage Lender Survey, a Mortgage Investment Corporation (MIC) survey, and CMHC’s residential Mortgage data-reporting framework of NHA MBS issuers. By making this type of information available to the public, we support evidence-based policy and informed decision making within the housing finance sector.”

“CMHC makes continuous efforts in filling data gaps across the housing spectrum as they are identified. This new report gathers information from several key initiatives and partnerships including the Non-Bank Mortgage Lender Survey, a Mortgage Investment Corporation (MIC) survey, and CMHC’s residential Mortgage data-reporting framework of NHA MBS issuers. By making this type of information available to the public, we support evidence-based policy and informed decision making within the housing finance sector.”

Associated links:

As Canada's authority on housing, CMHC contributes to the stability of the housing market and financial system, provides support for Canadians in housing need, and offers unbiased housing research and advice to all levels of Canadian government, consumers and the housing industry.

For more information, follow us on Twitter, YouTube, LinkedIn, Facebook and Instagram

Media contact:

Audrey-Anne Coulombe (Ottawa)

Media Relations, CMHC

613-748-2573

acoulomb@cmhc-schl.gc.ca

Angelina Ritacco (Toronto)

Media Relations, CMHC

416-218-3320

aritacco@cmhc-schl.gc.ca

Share via Email

Share via Email