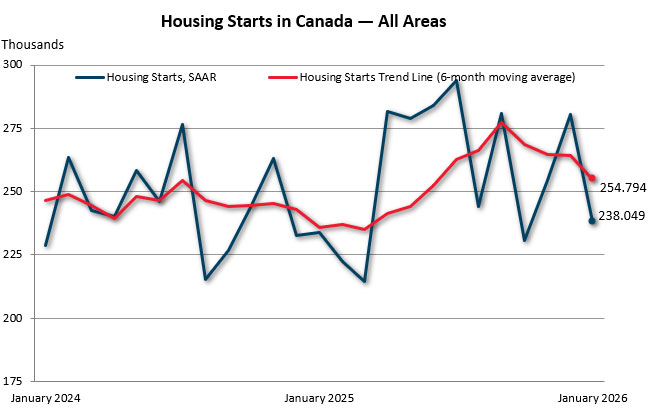

The six-month trend in housing starts decreased (3.5%) in January (254,794 units), according to Canada Mortgage and Housing Corporation (CMHC). The trend measure is a six-month moving average of the seasonally adjusted annual rate (SAAR) of total housing starts for all areas in Canada.

Actual housing starts were up 1% year-over-year in centres with a population of 10,000 or greater, with 16,088 units recorded in January, compared to 15,957 units in January 2025.

The total monthly SAAR of housing starts for all areas in Canada was down 15% in January (238,049 units) compared to December (280,668 units).

Quote:

“While actual starts in January were flat, the six-month trend has decreased for the fourth consecutive month, which is in line with recent signs of slowing momentum in residential construction,” said Tania Bourassa-Ochoa, CMHC’s Deputy Chief Economist. We expect new construction to continue trending lower going forward as trade and geopolitical uncertainty, high construction costs, weaker demand, and rising inventories continue to constrain developer activity. As a result, near-term improvements in housing supply are unlikely, reflecting the on-the-ground sentiments we’ve heard from developers over the past several months.”

Key facts:

- New: As part of the Modernizing Housing Data initiative, new housing completions data for centres with a population of 10,000+ and absorptions data for centres with a population of 50,000+ is now available on the Housing Market Information Portal.

- The rural starts monthly SAAR estimate was 19,867 units.

- Among Canada’s big three cities, Vancouver recorded a 37% increase in actual starts due to higher multi-unit and single-detached starts. Toronto declined 2% due to lower single-detached starts. Montreal posted a 44% year-over-year decrease this month, driven by lower multi-unit and single-detached starts.

- CMHC’s Starts and Completions Survey provides Canadians with objective, accurate and timely information on actual new residential construction in Canada. Read more about why housing starts matter on CMHC’s Housing Observer.

- Monthly Housing Starts and Other Construction Data are accessible in English and French on our website and the CMHC Housing Market Information Portal.

- Housing starts data is available on the eleventh business day each month. We will release the February housing starts data on March 16 at 8:15 AM ET.

- CMHC uses the trend measure as a complement to the monthly SAAR of housing starts to account for considerable swings in monthly estimates and to obtain a clearer picture of upcoming new housing supply. In some situations, analyzing only SAAR data can be misleading, as the multi-unit segment largely drives the market and can vary significantly from one month to the next.

- Read about our definitions and methodology to better understand the foundations of the Starts and Completions and Market Absorption surveys.

Housing starts facilitate the analysis of monthly, quarterly, and year-over-year activity in the new home market. The data CMHC collects as part of the Starts and Completions and Market Absorption surveys helps us obtain a clearer picture of upcoming new housing supply and is used as part of our various housing reports.

CMHC plays a critical role as a national convenor to promote stability and sustainability in Canada’s housing finance system. CMHC’s mortgage insurance products support access to home ownership and the creation and maintenance of rental supply. CMHC research and data help inform housing policy. By facilitating co-operation between all levels of government, private and non-profit sectors, CMHC contributes to advancing housing affordability, equity, and climate compatibility. CMHC actively supports the Government of Canada in delivering on its commitment to make housing more affordable.

Follow us on X, YouTube, LinkedIn, Facebook and Instagram.

Related links:

- Housing starts for December 2025

- CMHC’s 2026 Housing Market Outlook

- Housing shortages in Canada

- We built this city on… Development charges

- Framework for change: Productivity in housing construction

Information on this release:

To request an interview with a CMHC economist, contact:

Media Relations, CMHC

media@cmhc-schl.gc.ca

| Single-Detached | All Others | Total | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Dec. 2025 | Jan. 2026 | % | Dec. 2025 | Jan. 2026 | % | Dec. 2025 | Jan. 2026 | % | |

| N.L. | 740 | 755 | 2 | 449 | 446 | -1 | 1,189 | 1,200 | 1 |

| P.E.I. | 348 | 320 | -8 | 998 | 790 | -21 | 1,346 | 1,110 | -18 |

| N.S. | 1,606 | 1,601 | 0 | 7,653 | 5,667 | -26 | 9,259 | 7,268 | -22 |

| N.B. | 1,091 | 1,154 | 6 | 5,863 | 5,198 | -11 | 6,953 | 6,352 | -9 |

| Qc | 4,871 | 4,916 | 1 | 49,560 | 47,040 | -5 | 54,431 | 51,956 | -5 |

| Ont. | 9,945 | 10,144 | 2 | 57,380 | 55,616 | -3 | 67,324 | 65,760 | -2 |

| Man. | 2,214 | 2,105 | -5 | 5,908 | 5,696 | -4 | 8,122 | 7,801 | -4 |

| Sask. | 1,865 | 1,950 | 5 | 3,698 | 3,372 | -9 | 5,563 | 5,322 | -4 |

| Alta. | 13,808 | 13,243 | -4 | 35,804 | 35,579 | -1 | 49,612 | 48,822 | -2 |

| B.C. | 4,300 | 4,449 | 3 | 37,729 | 37,115 | -2 | 42,028 | 41,564 | -1 |

| Canada (10,000+) | 40,786 | 40,637 | 0 | 205,042 | 196,519 | -4 | 245,828 | 237,155 | -4 |

| Canada (All Areas) | 51,017 | 50,741 | -1 | 213,083 | 204,054 | -4 | 264,098 | 254,794 | -4 |

Data based on 2021 Census Definitions.

Source: Market Analysis Centre, CMHC

| Single-Detached | All Others | Total | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Dec. 2025 | Jan. 2026 | % | Dec. 2025 | Jan. 2026 | % | Dec. 2025 | Jan. 2026 | % | |

| Abbotsford – Mission | 183 | 181 | -1 | 1,502 | 1,154 | -23 | 1,685 | 1,335 | -21 |

| Barrie | 194 | 186 | -4 | 914 | 292 | -68 | 1,108 | 478 | -57 |

| Belleville – Quinte West | 172 | 160 | -7 | 568 | 402 | -29 | 740 | 562 | -24 |

| Brantford | 282 | 314 | 11 | 592 | 1,018 | 72 | 874 | 1,332 | 52 |

| Calgary | 5,937 | 5,840 | -2 | 19,664 | 20,338 | 3 | 25,601 | 26,178 | 2 |

| Chilliwack | 130 | 138 | 6 | 432 | 414 | -4 | 562 | 552 | -2 |

| Drummondville | 204 | 223 | 9 | 1,366 | 1,294 | -5 | 1,570 | 1,517 | -3 |

| Edmonton | 5,937 | 5,606 | -6 | 14,610 | 13,094 | -10 | 20,547 | 18,700 | -9 |

| Fredericton | 324 | 333 | 3 | 1,440 | 1,170 | -19 | 1,764 | 1,503 | -15 |

| Greater / Grand Sudbury | 113 | 105 | -7 | 344 | 306 | -11 | 457 | 411 | -10 |

| Guelph | 31 | 32 | 3 | 506 | 448 | -11 | 537 | 480 | -11 |

| Halifax | 843 | 868 | 3 | 6,454 | 4,666 | -28 | 7,297 | 5,534 | -24 |

| Hamilton | 361 | 344 | -5 | 4,074 | 2,592 | -36 | 4,435 | 2,936 | -34 |

| Kamloops | 89 | 112 | 26 | 450 | 898 | 100 | 539 | 1,010 | 87 |

| Kelowna | 248 | 257 | 4 | 1,318 | 1,348 | 2 | 1,566 | 1,605 | 2 |

| Kingston | 235 | 342 | 46 | 332 | 324 | -2 | 567 | 666 | 17 |

| Kitchener – Cambridge – Waterloo | 572 | 579 | 1 | 5,588 | 5,230 | -6 | 6,160 | 5,809 | -6 |

| Lethbridge | 364 | 336 | -8 | 118 | 114 | -3 | 482 | 450 | -7 |

| London | 387 | 385 | -1 | 4,224 | 4,222 | 0 | 4,611 | 4,607 | 0 |

| Moncton | 328 | 360 | 10 | 2,790 | 2,420 | -13 | 3,118 | 2,780 | -11 |

| Montréal | 1,479 | 1,487 | 1 | 28,742 | 26,963 | -6 | 30,221 | 28,451 | -6 |

| Nanaimo | 110 | 104 | -5 | 362 | 364 | 1 | 472 | 467 | -1 |

| Oshawa | 426 | 555 | 30 | 932 | 818 | -12 | 1,358 | 1,373 | 1 |

| Ottawa – Gatineau | 1,709 | 1,769 | 4 | 11,132 | 9,418 | -15 | 12,841 | 11,187 | -13 |

| Gatineau | 361 | 356 | -1 | 1,254 | 1,072 | -15 | 1,615 | 1,428 | -12 |

| Ottawa | 1,348 | 1,413 | 5 | 9,878 | 8,346 | -16 | 11,226 | 9,759 | -13 |

| Peterborough | 88 | 79 | -10 | 28 | 0 | -100 | 116 | 79 | -32 |

| Québec | 665 | 732 | 10 | 6,842 | 6,020 | -12 | 7,507 | 6,753 | -10 |

| Red Deer | 115 | 91 | -21 | 118 | 124 | 5 | 233 | 215 | -8 |

| Regina | 412 | 478 | 16 | 1,040 | 994 | -4 | 1,452 | 1,472 | 1 |

| Saguenay | 255 | 240 | -6 | 706 | 756 | 7 | 961 | 996 | 4 |

| St. Catharines – Niagara | 502 | 569 | 13 | 2,644 | 2,380 | -10 | 3,146 | 2,949 | -6 |

| Saint John | 275 | 293 | 7 | 598 | 530 | -11 | 873 | 823 | -6 |

| St. John's | 696 | 697 | 0 | 426 | 406 | -5 | 1,122 | 1,103 | -2 |

| Saskatoon | 1,401 | 1,420 | 1 | 2,642 | 2,358 | -11 | 4,043 | 3,778 | -7 |

| Sherbrooke | 243 | 224 | -8 | 1,740 | 1,740 | - | 1,983 | 1,964 | -1 |

| Thunder Bay | 78 | 75 | -4 | 184 | 292 | 59 | 262 | 367 | 40 |

| Toronto | 2,998 | 2,991 | 0 | 23,440 | 24,838 | 6 | 26,438 | 27,829 | 5 |

| Trois-Rivières | 159 | 159 | - | 1,258 | 1,252 | 0 | 1,417 | 1,411 | 0 |

| Vancouver | 2,269 | 2,293 | 1 | 26,440 | 25,818 | -2 | 28,709 | 28,111 | -2 |

| Victoria | 333 | 341 | 2 | 4,674 | 4,352 | -7 | 5,007 | 4,693 | -6 |

| Windsor | 300 | 280 | -7 | 1,332 | 940 | -29 | 1,632 | 1,220 | -25 |

| Winnipeg | 1,874 | 1,767 | -6 | 4,910 | 4,754 | -3 | 6,783 | 6,521 | -4 |

Data based on 2021 Census Definitions.

Source: Market Analysis Centre, CMHC

| Single-Detached | All Others | Total | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Jan. 2025 | Jan. 2026 | % | Jan. 2025 | Jan. 2026 | % | Jan. 2025 | Jan. 2026 | % | |

| N.-L. | 31 | 42 | 35 | 22 | 25 | 14 | 53 | 67 | 26 |

| P.E.I. | 13 | 13 | - | 190 | 87 | -54 | 203 | 100 | -51 |

| N.S. | 87 | 97 | 11 | 484 | 261 | -46 | 571 | 358 | -37 |

| N.B. | 33 | 47 | 42 | 44 | 293 | ## | 77 | 340 | 342 |

| Atlantic | 164 | 199 | 21 | 740 | 666 | -10 | 904 | 865 | -4 |

| Qc | 243 | 297 | 22 | 3,954 | 2,526 | -36 | 4,197 | 2,823 | -33 |

| Ont. | 550 | 550 | - | 3,438 | 3,905 | 14 | 3,988 | 4,455 | 12 |

| Man. | 148 | 121 | -18 | 264 | 152 | -42 | 412 | 273 | -34 |

| Sask. | 62 | 92 | 48 | 150 | 98 | -35 | 212 | 190 | -10 |

| Alta. | 972 | 697 | -28 | 2,345 | 2,644 | 13 | 3,317 | 3,341 | 1 |

| Prairies | 1,182 | 910 | -23 | 2,759 | 2,894 | 5 | 3,941 | 3,804 | -3 |

| B.C. | 254 | 276 | 9 | 2,673 | 3,865 | 45 | 2,927 | 4,141 | 41 |

| Canada (10,000+) | 2,393 | 2,232 | -7 | 13,564 | 13,856 | 2 | 15,957 | 16,088 | 1 |

Data for 2022 based on 2016 Census Definitions and data for 2023, 2024 and 2025 based on 2021 Census Definitions.

Source: CMHC Starts and Completion Survey, Market Absorption Survey

## not calculable / extreme value

| Single-Detached | All Others | Total | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Jan. 2025 | Jan. 2026 | % | Jan. 2025 | Jan. 2026 | % | Jan. 2025 | Jan. 2026 | % | |

| Abbotsford – Mission | 10 | 9 | -10 | 280 | 24 | -91 | 290 | 33 | -89 |

| Barrie | 3 | 4 | 33 | 18 | 6 | -67 | 21 | 10 | -52 |

| Belleville – Quinte West | 6 | 4 | -33 | 0 | 4 | ## | 6 | 8 | 33 |

| Brantford | 11 | 27 | 145 | 242 | 213 | -12 | 253 | 240 | -5 |

| Calgary | 552 | 415 | -25 | 1,077 | 1,645 | 53 | 1,629 | 2,060 | 26 |

| Chilliwack | 10 | 7 | -30 | 4 | 7 | 75 | 14 | 14 | - |

| Drummondville | 10 | 19 | 90 | 18 | 51 | 183 | 28 | 70 | 150 |

| Edmonton | 332 | 204 | -39 | 879 | 778 | -11 | 1,211 | 982 | -19 |

| Fredericton | 10 | 12 | 20 | 2 | 82 | ## | 12 | 94 | ## |

| Greater / Grand Sudbury | 2 | 4 | 100 | 0 | 4 | ## | 2 | 8 | 300 |

| Guelph | 1 | 1 | - | 1 | 13 | ## | 2 | 14 | ## |

| Halifax | 60 | 57 | -5 | 451 | 221 | -51 | 511 | 278 | -46 |

| Hamilton | 13 | 18 | 38 | 17 | 152 | ## | 30 | 170 | 467 |

| Kamloops | 11 | 21 | 91 | 8 | 398 | ## | 19 | 419 | ## |

| Kelowna | 17 | 18 | 6 | 343 | 185 | -46 | 360 | 203 | -44 |

| Kingston | 4 | 26 | ## | 166 | 11 | -93 | 170 | 37 | -78 |

| Kitchener – Cambridge – Waterloo | 17 | 33 | 94 | 179 | 151 | -16 | 196 | 184 | -6 |

| Lethbridge | 22 | 10 | -55 | 103 | 6 | -94 | 125 | 16 | -87 |

| London | 32 | 26 | -19 | 22 | 351 | ## | 54 | 377 | ## |

| Moncton | 8 | 9 | 13 | 8 | 150 | ## | 16 | 159 | ## |

| Montréal | 101 | 78 | -23 | 2,439 | 1,345 | -45 | 2,540 | 1,423 | -44 |

| Nanaimo | 4 | 0 | ### | 0 | 7 | ## | 4 | 7 | 75 |

| Oshawa | 6 | 34 | 467 | 0 | 7 | ## | 6 | 41 | ## |

| Ottawa – Gatineau | 103 | 105 | 2 | 685 | 438 | -36 | 788 | 543 | -31 |

| Gatineau | 12 | 37 | 208 | 310 | 129 | -58 | 322 | 166 | -48 |

| Ottawa | 91 | 68 | -25 | 375 | 309 | -18 | 466 | 377 | -19 |

| Peterborough | 6 | 2 | -67 | 0 | 0 | - | 6 | 2 | -67 |

| Québec | 38 | 54 | 42 | 488 | 228 | -53 | 526 | 282 | -46 |

| Red Deer | 16 | 3 | -81 | 12 | 6 | -50 | 28 | 9 | -68 |

| Regina | 7 | 21 | 200 | 96 | 19 | -80 | 103 | 40 | -61 |

| Saguenay | 9 | 13 | 44 | 48 | 67 | 40 | 57 | 80 | 40 |

| St. Catharines – Niagara | 28 | 70 | 150 | 83 | 100 | 20 | 111 | 170 | 53 |

| Saint John | 7 | 21 | 200 | 26 | 8 | -69 | 33 | 29 | -12 |

| St. John's | 30 | 41 | 37 | 22 | 23 | 5 | 52 | 64 | 23 |

| Saskatoon | 49 | 65 | 33 | 41 | 77 | 88 | 90 | 142 | 58 |

| Sherbrooke | 8 | 14 | 75 | 53 | 40 | -25 | 61 | 54 | -11 |

| Thunder Bay | 3 | 1 | -67 | 14 | 80 | 471 | 17 | 81 | 376 |

| Toronto | 219 | 152 | -31 | 2,149 | 2,160 | 1 | 2,368 | 2,312 | -2 |

| Trois-Rivières | 11 | 9 | -18 | 40 | 48 | 20 | 51 | 57 | 12 |

| Vancouver | 141 | 146 | 4 | 1,866 | 2,603 | 39 | 2,007 | 2,749 | 37 |

| Victoria | 15 | 19 | 27 | 90 | 388 | 331 | 105 | 407 | 288 |

| Windsor | 13 | 7 | -46 | 31 | 8 | -74 | 44 | 15 | -66 |

| Winnipeg | 133 | 110 | -17 | 236 | 118 | -50 | 369 | 228 | -38 |

| Total | 2,078 | 1,889 | -9 | 12,237 | 12,222 | 0 | 14,315 | 14,111 | -1 |

Data for 2022 based on 2016 Census Definitions and data for 2023, 2024 and 2025 based on 2021 Census Definitions.

Source: CMHC Starts and Completion Survey, Market Absorption Survey

## not calculable / extreme value

Share via Email

Share via Email