10% of Canadian households were in core housing need in 2021

- 20% of renter households were in core housing need, 89% of which were facing affordability issues.

- For those who struggle with affordability, the median earning shortfall to escape affordability issues was about $2,600 in 2021.

Indigenous households

- 1.3 times more often to be in core housing need or live in over-crowded dwellings than non-Indigenous households.

- 1.9 times more likely than non-Indigenous households to live in dwellings in need of major repairs.

Women

- 12.8% of female+-led households are in core housing need.

- 23% of female+ senior-led (65+) persons living alone (one-person households) are in core housing need, compared to 20% for male+ households in the same situation.

Lone-parent households with children

- 18% of households in core housing need, 79% of which were in core housing need for affordability reasons.

- 19% female+-led lone-parent family households in core housing need compared to 13% male+-led family households.

Immigrant-led households

- 14% of immigrant-led households in core housing need, 16% for recent immigrant-led households.

- 19% of refugee-led households in core housing need, 33.0% for recent refugee-led households.

Racialized households

- 15% of racialized households are in core need compared to 9% of non-racialized households.

Persons with disabilities

- 10% of persons with disabilities are in core housing need compared to 7% amongst persons without disabilities.

Northern housing

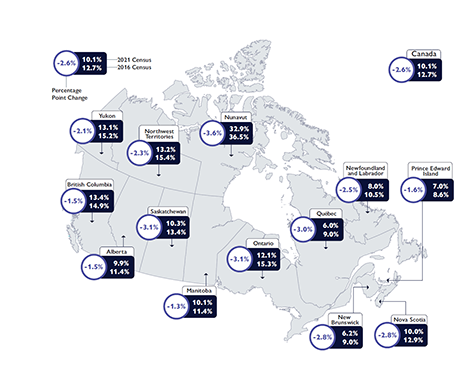

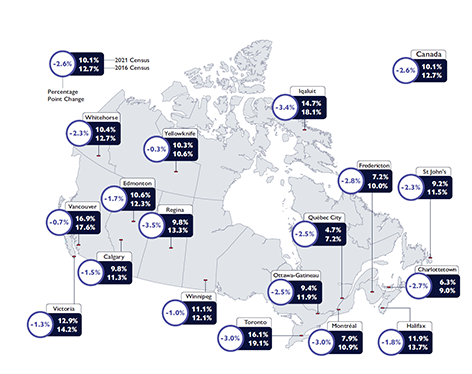

- Nunavut had the highest incidence of core housing need amongst provinces and territories in Canada at 33%. In Yukon and Northwest Territories, 13% of households were in core housing need.

Learn more about core housing need

- Core Housing Need Data Tables offer housing professionals and researchers key insights into Canadian households, including home equity, incomes, housing types and core housing need.

- Knowledge Centre specializes in housing literature and statistics on core housing need, featuring our research, National Housing Strategy deliverables, and global publications.

- Housing Market Information Portal provides access to the latest housing market data for Canada.

- Housing Need Research analyzes the housing needs and conditions of underserved populations, influenced by systemic factors, to better understand core housing needs and inform policies for vulnerable groups.

- Household Characteristics data offers key household characteristics in Canada, including income, housing types, demographics, and core housing need.

Share via Email

Share via Email