Our new analysis expands on the increase in the supply of rental condominiums in the Vancouver Census Metropolitan Area (CMA) in 2019. We discuss the conversion of existing units to rental and the implications for housing policy.

Our objective is that these insights will help stakeholders make well-informed decisions to promote housing supply and affordability in the Vancouver region.

Highlights

- Condominium apartments are an important source of rental supply in the Vancouver CMA. A record 11,118 units were added in 2019. This is an increase of 18.9% over 2018.

- The conversion of existing units to long-term rental units was the largest contributor (8,824 units) to the increase in supply in 2019.

- A combination of market factors and housing policies designed to encourage long-term rental likely had an impact on the supply of rental condominiums.

Condominiums are an important source of rental supply for the Vancouver region

The Vancouver CMA is a region with a growing population and high homeownership costs. As a result, there has been strong demand for rental housing in in recent years. This demand has not been met by sufficient new supply of rental housing. This has led to:

- rising rents

- persistently low vacancy rates

- housing affordability challenges for many households

While the number of purpose-built rental apartments has increased by a small amount over the past few years, condominium apartments rented by investor-owners to long-term tenants have represented most of the net additions to the region’s rental market in the past decade. This growing and important source of rental supply has the potential to be more volatile than purpose-built apartments. For example, investor-owners can sell or repurpose their properties on short notice, thus removing their units from the long-term rental market.

Since 2017, various levels of government have introduced policies to promote and stabilize the supply of long-term rental condominium units. While it is beyond the scope of this work to evaluate the effectiveness of the individual policies, we can describe the scale of the changes in the supply of rental condominiums that occurred between 2018 and 2019 in this policy environment.

The conversion of existing units to long-term rental was the largest contributor to the increase in the supply of rental condominiums in 2019

The Vancouver CMA saw an unprecedented increase in the number of condominiums active in the long-term rental market between 2018 and 2019. More information can be found in our 2019 Rental Market Report (PDF).

The number of rental condominiums increased by an estimated 11,118 units (+18.9%). This exceeds the number of new condominiums completed during the year for the first time. This means, necessarily, that some existing units previously used for other purposes were converted to long-term rental, even if all newly completed units were to enter the rental market.

The increase of 11,118 rental condominiums in 2019 in the Vancouver CMA was the sum of two parts:

- An increase of 2,294 rental units from new condominiums completed between the 2018 and 2019 survey years. These units were purchased by investors who immediately offered them for rent on the long-term rental market upon completion.

- An increase of 8,824 rental units from existing condominiums that were converted to being offered as long-term rental units in 2019. These units were previously used for other purposes by their owners or changed owners between the two survey years, at which point, the new owner opted to rent out the unit.

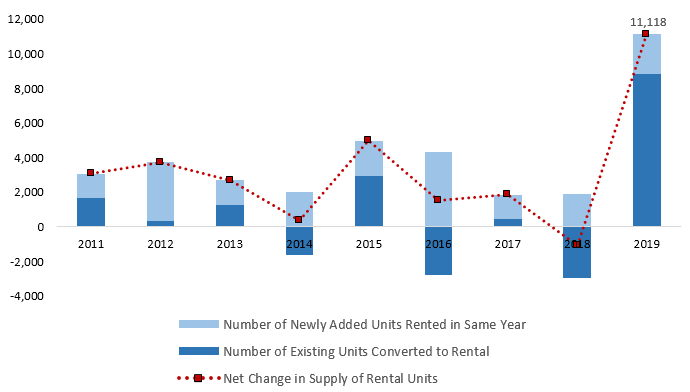

Placed in a historical context, it is clear that the increase in the supply of rental condominiums in 2019 is an outlier. Following losses of several thousand existing rental condominiums to other uses in 2016 and 2018, the conversion of 8,824 existing units to rental units is more than two times the standard deviation above the mean for the 2011 – 2019 period (figure 1 and table 1).

Figure 1. Components of Change in supply of Rental Condominium Apartments, Vancouver CMA

Source: CMHC

| Number of Existing Units Converted to Rental | Number of Newly Added Units Rented in Same Year | Net Change in Supply of Rental Units | |

|---|---|---|---|

| 2011 | 1,651 | 1,409 | 3,060 |

| 2012 | 315 | 3,409 | 3,724 |

| 2013 | 1,230 | 1,466 | 2,696 |

| 2014 | -1,637 | 2,011 | 374 |

| 2015 | 2,935 | 2,040 | 4,975 |

| 2016 | -2,796 | 4,312 | 1,516 |

| 2017 | 474 | 1,367 | 1,841 |

| 2018 | -2,992 | 1,911 | -1,081 |

| 2019 | 8,824 | 2,294 | 11,118 |

| Mean (2011 – 2019) | 889 | 2,247 | 3,136 |

| Standard deviation (2011 – 2019) | 3,595 | 995 | 3,488 |

Source: CMHC

Market factors and housing policies designed to encourage long-term rental units likely having an impact on the supply of rental condominiums in the Vancouver CMA

Several factors could have contributed to the increase in the supply of condominiums in the long-term rental market in 2019.

First, rental demand has been strong in the Vancouver CMA, with purpose-built rental vacancy rates at or below 1% for six consecutive years. This creates opportunities for condominium investors to rent their units to long-term tenants, since rented condominiums are an important source of rental supply in the region. Indeed, despite the increase of 11,118 rental condominium units in 2019, condominium vacancy rates remained unchanged at 0.3%. This suggests the increase in supply was fully met by demand in the rental market.

Second, strong price appreciation in the condominium market over the past few years has meant that many owners have made significant capital gains. Some owners may have chosen to sell their units, and the new owners may have added to the long-term rental market units that were previously owner-occupied, vacant, or rented short-term.

Third, a number of housing policies from different levels of government have come into effect over the past two years, particularly for second or investment properties. These include:

- the B.C. Government’s Speculation and Vacancy Tax. An annual tax based on the property’s value, use, and ownership designed to turn empty homes into housing for British Columbians.

- the City of Vancouver’s Empty Homes Tax. This applies to properties that are not a principal residence or rented for at least six months of the year.

- business licensing requirements and restrictions on short-term rentals in the City of Vancouver. These limit short-term rentals to an owner’s principal residence.

In the case a property owner has a second property in the City of Vancouver, all three regulations would apply. This creates strong incentives to rent the unit long-term as opposed to leaving it vacant1 or renting it short-term.

The phase-in periods and exemptions around these housing policies began to expire in 2019. It is likely that these policies played a role in owners’ evaluation of the best use of their properties, contributing to the supply of condominiums in the region’s long-term rental market.

Conversions of condominiums from other uses to long-term rental were strongest in the City of Vancouver

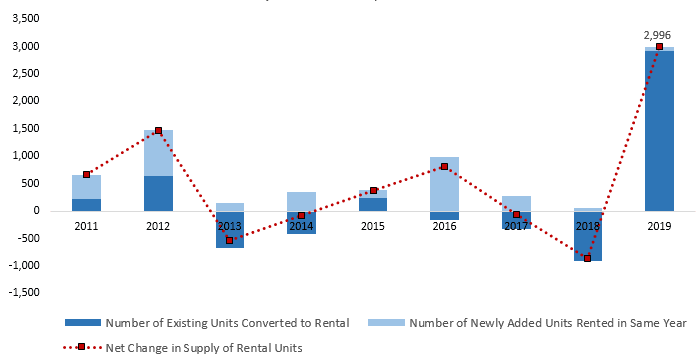

Of the 8,824 units converted to long-term rental in the Vancouver CMA in 2019, an estimated 5,097 (58%) were located in the City of Vancouver. By comparison, the City of Vancouver is home to only 37% of the region’s condominium housing, suggesting the factors influencing the observed change in market participation were strongest in this municipality. This important increase follows three consecutive years where the existing condominium universe recorded losses of long-term rental units (figure 2).

Figure 2. Components of Change in Number of Rented Condominium Apartments, City of Vancouver

| Number of Existing Units Converted to Rental | Number of Newly Added Units Rented in Same Year | Net Change in Supply of Rental Units | |

|---|---|---|---|

| 2011 | 574 | 521 | 1,095 |

| 2012 | 354 | 1,480 | 1,834 |

| 2013 | -253 | 623 | 370 |

| 2014 | -755 | 729 | -26 |

| 2015 | 1,035 | 753 | 1,788 |

| 2016 | -770 | 2,894 | 2,124 |

| 2017 | -265 | 522 | 257 |

| 2018 | -959 | 721 | -238 |

| 2019 | 5,097 | 823 | 5,920 |

| Mean (2011 – 2019) | 451 | 1,007 | 1,458 |

| Standard deviation (2011 – 2019) | 1,867 | 763 | 1,885 |

Source: CMHC

Within the City of Vancouver, the number of condominiums converted to long-term rental units was further concentrated in the downtown area (figure 3). The central location of this area means that it has been a popular location for short-term vacation rentals, as well as condominiums that are second residences for owners who reside elsewhere.2

Following several years of losses of existing units from the long-term rental market, the change in market participation in 2019 in downtown Vancouver was likely impacted by the combination of housing policies introduced to encourage the rental of condominiums to long-term tenants.

In addition, the number of units converted exceeded the number of condominium sales in the area during the period. This means a significant number of conversions were undertaken by existing owners, even if all condominium sales were to investors who then rented the units long-term (see special topic) .

Figure 3. Components of Change in Number of Rented Condominium Apartments, City of Vancouver, Downtown

Source: CMHC

| Number of Existing Units Converted to Rental | Number of Newly Added Units Rented in Same Year | Net Change in Supply of Rental Units | |

|---|---|---|---|

| 2011 | 227 | 433 | 660 |

| 2012 | 646 | 833 | 1,479 |

| 2013 | -676 | 141 | -535 |

| 2014 | -424 | 345 | -79 |

| 2015 | 237 | 144 | 381 |

| 2016 | -165 | 979 | 814 |

| 2017 | -331 | 275 | -56 |

| 2018 | -918 | 59 | -859 |

| 2019 | 2,928 | 68 | 2,996 |

| Mean (2011 – 2019) | 169 | 364 | 533 |

| Standard deviation (2011 – 2019) | 1143 | 334 | 1166 |

Source: CMHC

The stability of rental condominium supply is important for meeting the housing needs of renters in Metro Vancouver

Following our analysis, several conclusions in the current market and policy context can be drawn.

- Any impact of the recently introduced housing policy measures on the long-term rental supply is likely to be one-time, as opposed to ongoing. We can hypothesize that most condominium owners who were incentivized to rent or sell their units have likely now done so. Additionally, so long as the policies remain in place, we would not expect the units brought to the rental market to be further repurposed.

- The combination of housing policies applicable in the City of Vancouver meant that the potential impact on the provision of long-term rental supply was highest there. This is supported by the data presented, suggesting that the combination of policies in the City of Vancouver resulted in a greater change in the number of rental condominiums than elsewhere in the Vancouver CMA.

- That 11,118 condominium units could be added to the Vancouver CMA long-term rental market in 2019 with no change in the condominium vacancy rate demonstrates the region’s strong demand for rental units — new rental households can only be formed when there are units available for them. Additionally, while average rents for purpose-built units increased 4.7% in 2019 compared with 2018, rents for condominium units were unchanged. We can hypothesize that the increased supply and competition among landlords contributed to the difference in the pace of rent increase between the two segments.

While condominium units are an important source of rental supply for the region, that supply is volatile, owing to the flow of units into and out of the rental market. This volatility poses challenges to security of tenure for long-term tenants.

In addition to greater participation by condominium investors, the Vancouver CMA therefore needs a greater supply of purpose-built rental units to provide stable, long-term housing options for tenants, along with the associated economic and societal benefits. As a result, we view a growing rental supply as central to providing more choices and promoting housing affordability in the region.

CMHC’s 2020 Condominium Apartment Survey results and the impact of the pandemic on the rental housing sector

The 2020 pandemic will result in additional changes to both supply and demand in the Vancouver rental market.

For example, there has been a slowdown in global travel due to the coronavirus. This could cause some additional condominium owners who currently rent their units as short-term vacation rentals to bring their units to the long-term rental market, in the hopes of taking advantage of more stable income and demand.

We look forward to being able to provide insights on this and other market developments in our 2020 Rental Market Report, which will be released in mid-January 2021, as well as in subsequent publications.

Sign up for our Housing Research newsletter. You will be notified when the 2020 Rental Market Report, and other reports, analysis and data are available.

Share via Email

Share via Email