There was an increase in single-family home purchases in the Gatineau, Quebec metropolitan area1 in 2020, despite the COVID-19 pandemic. We explore how the pandemic may have impacted the dynamics of the real estate market in the Gatineau area in the April 2021 Housing Market Insight.

Highlights

- Land register data enable us to measure changes in the dynamics of the real estate market. This provides the data to see the increase in single-family home purchases in the Gatineau metropolitan area in 2020.

- Moves from the city of Gatineau to the outskirts of the Census Metropolitan Area (CMA) accelerated. There was an increase in the proportion of buyers of single-family homes who left the city of Gatineau to settle elsewhere in the CMA.

- Demand from Ottawa households was higher than before. The purchase of single-family homes by Ottawa households doubled in the Gatineau metropolitan area in 2020. This is possibly as a result of the appeal of a more affordable market in these uncertain economic times.

Increase in the proportion of households from the city that purchased single-family homes in the outlying areas

Five years prior to the pandemic, the proportion of single-family home buyers from the city of Gatineau who moved elsewhere in the CMA was 9% to 10%. In 2020, this proportion increased to 12% (see table 1).

| Destination | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | Increase in 2020 (percentage points) |

|---|---|---|---|---|---|---|---|

| Elsewhere in the city | 88% | 88% | 89% | 89% | 89% | 85% | -4 |

| To the outskirts of the city (within the CMA) | 10% | 10% | 10% | 9% | 9% | 12% | 3 |

| Outside the CMA (adjacent municipalities) | 2% | 2% | 2% | 2% | 2% | 3% | 1 |

| Total | 100% | 100% | 100% | 100% | 100% | 100% | - |

Source: JLR, an Equifax company.

The number of buyers from the city who purchased a home on the outskirts of the city (but still within the CMA) increased by about 40% in 2020 (see table 2).

| Destination | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | Increase in 2020 |

|---|---|---|---|---|---|---|---|

| Elsewhere in the city | 2,700 | 2,920 | 2,960 | 2,980 | 3,360 | 3,515 | 5% |

| To the outskirts of the city (within the CMA) | 310 | 340 | 320 | 310 | 340 | 485 | 43% |

| Outside the CMA (adjacent municipalities) | 60 | 60 | 60 | 60 | 65 | 115 | 77% |

| Total | 3,070 | 3,320 | 3,340 | 3,350 | 3,765 | 4,115 | 9% |

Note: Estimates. Figures have been rounded off.

Source: JLR, an Equifax company.

These households from the city of Gatineau who purchased homes in the outlying areas came mainly from the Gatineau sectors, followed by Aylmer. Outlying municipalities that recorded the largest increases in buyers from the city were:

- Val-des-Monts (40%)

- Cantley (40%)

- Pontiac (144%)

- Thurso (76%)

The number of buyers from the city who moved further away was increased in 2020, but is still considered low. The percentage of single-family home buyers from the city who moved to a municipality outside the CMA, but still adjacent to it, rose from about 2% to 3%.

This change in demand could also be seen in households already on the outskirts of the city. Previous numbers indicated an average of 3% of single-family home buyers from the outskirts moved to a municipality adjacent to the CMA. This proportion increased to 4.5% in 2020.

Higher number of buyers from the Ottawa metropolitan area

Households that come from outside the Gatineau metropolitan area to settle there are mainly from the Ottawa metropolitan area.2 Typically, 3 times as many of them purchase single-family homes in the area compared to households from the Montréal CMA, which corresponds to:

- close to 300 buyers from Ottawa

- fewer than 100 from Montréal

In 2020, this ratio increased to 5:1 — close to 700 buyers from Ottawa compared to about 130 from Montréal. This change suggests that Ottawa households are increasingly attracted to Gatineau, which is supported by migration data.

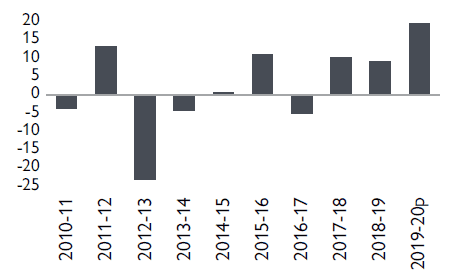

For 2019 – 20203, the number of people who left another province in Canada to settle in the Gatineau metropolitan area increased by 19%4 (see figure 1). More than half of these interprovincial migrants come from the Ottawa metropolitan area5.

Figure 1: Increase in the number of interprovincial in-migrants for the Gatineau metropolitan area (%)

| Year | Percent |

|---|---|

| 2010 – 11 | - 4 |

| 2011 – 12 | 13 |

| 2012 – 13 | - 23 |

| 2013 – 14 | - 4 |

| 2014 – 15 | 1 |

| 2015 – 16 | 11 |

| 2016 – 17 | - 5 |

| 2017 – 18 | 10 |

| 2018 – 19 | 9 |

| 2019 – 20p | 19 |

p: Preliminary data.

Source: Statistics Canada, data adapted by the Institut de la statistique du Québec (ISQ).

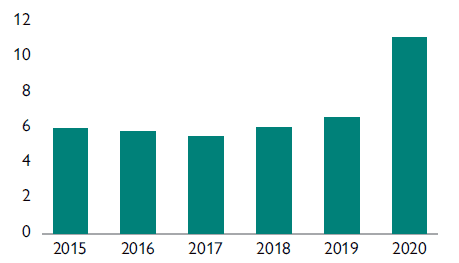

In 2020, households from the Ottawa metropolitan area accounted for 11% of single-family home purchases in the Gatineau metropolitan area. This is compared to 6% on average in the previous five years (see figure 2).

In absolute numbers, single-family home purchases by Ottawa households doubled in the area from 350 to close to 700.

Conversely, the share of buyers from the Gatineau metropolitan area declined from 86% to 81% over the same period. Ottawa buyers settled mainly in the Aylmer sector and transactions in this area doubled in 2020.

Figure 2: Proportion of single-family home buyers in the Gatineau metropolitan area coming from the Ottawa metropolitan area (%)

| Year | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

|---|---|---|---|---|---|---|

| Percent | 6 | 6 | 6 | 6 | 7 | 11 |

Ottawa households now account for a much larger share of Gatineau’s housing demand. Their numbers are sufficient to account for the strong growth in transactions.

Ottawa households attracted by a more affordable market

From 2005 to 2015, the price of a single-family home in Ottawa remained about 45% higher than in Gatineau. Since 2019, evidence of price acceleration in the Ottawa market led to more rapid growth than in Gatineau, pushing the difference to 66%.

Lower prices in the Gatineau area offer more housing choices to Ottawa households than what their income6 would allow them to purchase if they remained in their area of origin. Buyers from Ottawa tend to purchase more expensive single-family homes than local buyers.

This additional demand for single-family homes in the higher price ranges could potentially add to the price pressure already evident in the Gatineau market.

Download the full report (PDF)

Get new analysis and reports as soon as they are released, sign up to receive our Housing Research Newsletter.

Footnotes

- Quebec portion of the Ottawa-Gatineau CMA.

- Ontario portion of the Ottawa-Gatineau CMA.

- Year: July 1 to June 30.

- Source: Statistics Canada.

- For 2018 – 2019 (most recent data available), 54% of interprovincial migration to Gatineau came from Ottawa.

- All other things being equal, excluding the impact of soft costs and the change in tax regime.

Share via Email

Share via Email